I'm not sure if anyone's gone to the GAWC website, recently, but I found this mini-update from 3/3/06. It's a pretty interesting read on the changing patterns of interconnectivity for anyone's who's interested:

http://www.lboro.ac.uk/gawc/rb/rb192.html>

Thursday, April 26, 2007

Your favourite cities of USA

What's the list of your favorites big cities in the USA? and what do you think about their?

- New York

- Los Ãngeles

- Washington

- Miami

- San Francisco

- Chicago

- Las Vegas

- Orlando

Thank you!>

- New York

- Los Ãngeles

- Washington

- Miami

- San Francisco

- Chicago

- Las Vegas

- Orlando

Thank you!>

New Rise in Number of Millionaire American Families

New Rise in Number of Millionaire Families

By DAVID CAY JOHNSTON

Published: March 28, 2006

The number of American households with a net worth of $1 million or more, excluding their principal residence, grew to a record 8.9 million last year, the British market research firm TNS Financial Services said in a report to be released today.

More than one in seven of the households were in just 13 of the nation's 3,140 counties, TNS said.

The number of millionaire families rose to 7.1 million in 1999, said Jeanette Luhr, a TNS manager who directed the survey, and then, after the Internet bubble burst, dropped steadily to 5.5 million by 2002. The ranks of millionaire households rose to 6.2 million in 2003 and 8.2 million in 2004, she said.

In most large counties, about one household in 12, or about 8.5 percent, was worth $1 million or more, Ms. Luhr said. An exception was Nassau County on Long Island, where millionaire families were more than twice as common, at 17.5 percent of all households.

The households had an average net worth, excluding principal residence, of nearly $2.2 million, of which more than $1.4 million was in liquid, or investable, assets. The survey counted some tax-deferred retirement savings but did not include individual retirement accounts in the liquid assets.

Despite a rising stock market, Ms. Luhr said that more than half of those surveyed said they had "become much more conservative in their investment approach over the past year."

The survey found that 29 percent of the millionaire households did not own stocks or bonds and 32 percent did not own mutual funds. One in four had a second mortgage on a home.

Half of the heads of millionaire households were 58 or older, Ms. Luhr said, and 45 percent were retired.

Just 18.7 percent of the millionaires own — or owned before they retired — part of a business or professional practice, an indication that high-wage earners who save and invest are the dominate group, at least among those on the lower rungs of the millionaire class.

TNS also found that while 73 percent of those it surveyed said they would prefer to do all of their financial business at a single institution, hardly anyone did.

Ms. Luhr said that 195 counties had at least 10,000 millionaires and that slightly more than a third of all counties had at least 1,000 millionaires.

Copyright 2006The New York Times Company>

By DAVID CAY JOHNSTON

Published: March 28, 2006

The number of American households with a net worth of $1 million or more, excluding their principal residence, grew to a record 8.9 million last year, the British market research firm TNS Financial Services said in a report to be released today.

More than one in seven of the households were in just 13 of the nation's 3,140 counties, TNS said.

The number of millionaire families rose to 7.1 million in 1999, said Jeanette Luhr, a TNS manager who directed the survey, and then, after the Internet bubble burst, dropped steadily to 5.5 million by 2002. The ranks of millionaire households rose to 6.2 million in 2003 and 8.2 million in 2004, she said.

In most large counties, about one household in 12, or about 8.5 percent, was worth $1 million or more, Ms. Luhr said. An exception was Nassau County on Long Island, where millionaire families were more than twice as common, at 17.5 percent of all households.

The households had an average net worth, excluding principal residence, of nearly $2.2 million, of which more than $1.4 million was in liquid, or investable, assets. The survey counted some tax-deferred retirement savings but did not include individual retirement accounts in the liquid assets.

Despite a rising stock market, Ms. Luhr said that more than half of those surveyed said they had "become much more conservative in their investment approach over the past year."

The survey found that 29 percent of the millionaire households did not own stocks or bonds and 32 percent did not own mutual funds. One in four had a second mortgage on a home.

Half of the heads of millionaire households were 58 or older, Ms. Luhr said, and 45 percent were retired.

Just 18.7 percent of the millionaires own — or owned before they retired — part of a business or professional practice, an indication that high-wage earners who save and invest are the dominate group, at least among those on the lower rungs of the millionaire class.

TNS also found that while 73 percent of those it surveyed said they would prefer to do all of their financial business at a single institution, hardly anyone did.

Ms. Luhr said that 195 counties had at least 10,000 millionaires and that slightly more than a third of all counties had at least 1,000 millionaires.

Copyright 2006The New York Times Company>

Best (US) cities for an oil crisis

Dense metropolitan areas with low sprawl dominate Top 10 list compiled by SustainLane.

SustainLane ranked the Top 10 cities nationwide prepared for a spike in oil prices.

Rank City

1. New York City

2. Boston

3. San Francisco

4. Chicago

5. Philadelphia

6. Portland

7. Honolulu

8. Seattle

9. Baltimore

10.Oakland

NEW YORK (CNNMoney.com ) - New Yorkers may complain endlessly about the city's public transportation system, but the network of subways and train lines may be the city's saving grace in the case of an oil crisis.

According to SustainLane, a Web site that promotes sustainable living, New York is the best city prepared for a surge in oil prices, largely because people there are committed to riding over driving.

SustainLane compiled a list of the best cities to live and work should gas prices suddenly spike. The group ranked cities according to their residents' commute practices, which was weighted most heavily, as well as public transportation ridership and city sprawl. Traffic congestion and local food and wireless network access also were taken into account.

Dense metropolitan cities with strong public transportation networks, such as Boston, San Francisco and Chicago, dominated the Top 10 list of cities prepared for a sudden spike in gas prices.

Philadelphia was praised for its abundant farmers markets and community gardens. The local food production network would provide a good alternative to having food trucked across the country in case of an oil crisis, SustainLane said.

Seattle also made the Top 10 list, leading the cities in wireless connectivity. That would come in handy as telecommuting could be an important way for large numbers of people to work from home in the case of a gas shortage.

The nationwide average price for regul ar unleaded has jumped about 12 percent in the last month to $2.509 a gallon Friday, according to AAA's daily fuel report.

Rising crude prices, which are back above $64 a barrel, are also fueling concerns about gas shortages as the summer driving season approaches.>

SustainLane ranked the Top 10 cities nationwide prepared for a spike in oil prices.

Rank City

1. New York City

2. Boston

3. San Francisco

4. Chicago

5. Philadelphia

6. Portland

7. Honolulu

8. Seattle

9. Baltimore

10.Oakland

NEW YORK (CNNMoney.com ) - New Yorkers may complain endlessly about the city's public transportation system, but the network of subways and train lines may be the city's saving grace in the case of an oil crisis.

According to SustainLane, a Web site that promotes sustainable living, New York is the best city prepared for a surge in oil prices, largely because people there are committed to riding over driving.

SustainLane compiled a list of the best cities to live and work should gas prices suddenly spike. The group ranked cities according to their residents' commute practices, which was weighted most heavily, as well as public transportation ridership and city sprawl. Traffic congestion and local food and wireless network access also were taken into account.

Dense metropolitan cities with strong public transportation networks, such as Boston, San Francisco and Chicago, dominated the Top 10 list of cities prepared for a sudden spike in gas prices.

Philadelphia was praised for its abundant farmers markets and community gardens. The local food production network would provide a good alternative to having food trucked across the country in case of an oil crisis, SustainLane said.

Seattle also made the Top 10 list, leading the cities in wireless connectivity. That would come in handy as telecommuting could be an important way for large numbers of people to work from home in the case of a gas shortage.

The nationwide average price for regul ar unleaded has jumped about 12 percent in the last month to $2.509 a gallon Friday, according to AAA's daily fuel report.

Rising crude prices, which are back above $64 a barrel, are also fueling concerns about gas shortages as the summer driving season approaches.>

Chinese Cities Need More Community Retail

Chinese mega-cities need more community retail stores

29 March 2006

Copyright 2006 China Daily Information Company. All Rights Reserved.

In addition to warehouse supermarkets run by Carrefour, Wal-Mart and Metro, Chinese mega-cities are in need of more groceries and chain stores in expanding residential communities.

Retail business experts and developers convened at a recent meeting held in this capital of Central China's Hunan Province reckoned that communities retail business will become a new economic growth pole in big cities in pace with the prosperous housing development.

The country's capital city of Beijing will see 4,000 retail stores built in expanding residential communities in the next five years to facilitate people's lives, according to the urban commercial planning department.

Wang Xiaochuan, deputy director of the Reform and Development Department under the Ministry of Commerce, forecast that it will take three to five years for 160 big Chinese cities with a population of more than one million to create a mature retail business environment to cater to the need of community life.

Guo Zengli, director-general of the Shopping Center Commission under the China Commercial Association, said that in big cities such as Beijing and Shanghai, concentrated shopping districts are usually separated with residential areas under the urban planning. In contrast to duplicated construction of big shopping malls, the lack of community-based retail stores has been urbanites' major complaints.

In Shenyang, capital of Northeast China's Liaoning Province, 30 percent of the retail revenue will be generated from community stores in the next five years, compared with the current level of 10 percent.

New housing development projects in the city have left ground floors for retail businesses. A real estate developer said that usually one seventh of housing development area is reserved for retailers.

With China's economy growing at more than 9 percent a year, the retail market is expected to expand by 8 to 10 percent a year to 2.4 trillion US dollars by 2020.>

29 March 2006

Copyright 2006 China Daily Information Company. All Rights Reserved.

In addition to warehouse supermarkets run by Carrefour, Wal-Mart and Metro, Chinese mega-cities are in need of more groceries and chain stores in expanding residential communities.

Retail business experts and developers convened at a recent meeting held in this capital of Central China's Hunan Province reckoned that communities retail business will become a new economic growth pole in big cities in pace with the prosperous housing development.

The country's capital city of Beijing will see 4,000 retail stores built in expanding residential communities in the next five years to facilitate people's lives, according to the urban commercial planning department.

Wang Xiaochuan, deputy director of the Reform and Development Department under the Ministry of Commerce, forecast that it will take three to five years for 160 big Chinese cities with a population of more than one million to create a mature retail business environment to cater to the need of community life.

Guo Zengli, director-general of the Shopping Center Commission under the China Commercial Association, said that in big cities such as Beijing and Shanghai, concentrated shopping districts are usually separated with residential areas under the urban planning. In contrast to duplicated construction of big shopping malls, the lack of community-based retail stores has been urbanites' major complaints.

In Shenyang, capital of Northeast China's Liaoning Province, 30 percent of the retail revenue will be generated from community stores in the next five years, compared with the current level of 10 percent.

New housing development projects in the city have left ground floors for retail businesses. A real estate developer said that usually one seventh of housing development area is reserved for retailers.

With China's economy growing at more than 9 percent a year, the retail market is expected to expand by 8 to 10 percent a year to 2.4 trillion US dollars by 2020.>

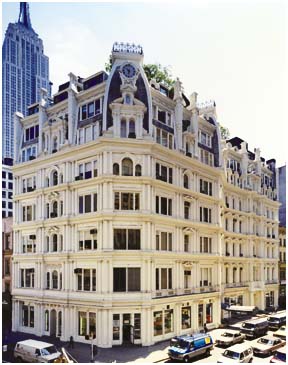

The Most Beautiful City In The US

I regard NY, Boston, DC and Philly to be the most beautiful cities in the US. SF's geography is beautiful, but its buildings are not as grand as those in the Northeast which are much older cities.

What cities do you regard as the most beautiful? Please post photos.

The following photos are in NY. Boston, DC and Philly will follow.

>

>

What cities do you regard as the most beautiful? Please post photos.

The following photos are in NY. Boston, DC and Philly will follow.

>

>

Subscribe to:

Comments (Atom)

>

>